Electric Scooter Market Size, Share, Trends & Analysis by 2030

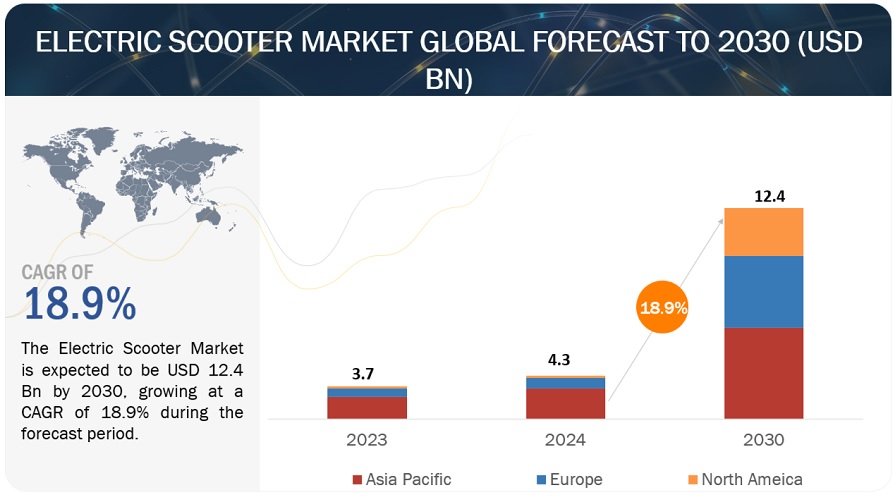

According to a research report “Electric Scooter Market by Vehicle (E-Scooter/Moped, E-Motorcycle), Voltage (36V, 48V, 60V, 72V, Above 72V), Motor Type (Hub and Mid-drive), Battery (Li-ion and lead acid), Motor Power, Technology, Vehicle Class, Usage & Region – Global Forecast to 2030″ published by MarketsandMarkets, the global Electric Scooter market is projected to grow from USD 4.3 billion in 2024 to USD 12.4 billion by 2030, registering a CAGR of 18.9%.

The global market for electric scooters is experiencing significant growth, driven by a combination of environmental, economic, and technological factors. Increasing environmental awareness and stringent government regulations to reduce emissions have prompted consumers and manufacturers to adopt more sustainable transportation options. Advances in battery technology have enhanced the performance, range, and charging efficiency of electric two-wheelers, making them more practical and appealing. Additionally, integrating smart technologies, such as GPS and IoT connectivity, has improved the user experience, while the rise of shared mobility services has expanded their accessibility and convenience in urban areas. These developments and substantial investments from major automotive companies and startups propel the widespread adoption and growth of electric scooters worldwide.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=142827777

“The 1.5–3 kW segment to show a significant growth rate during the forecast period.”

The less than 100 kW market is projected to register a CAGR of 19.2% during the forecast period. The power output of medium-power electric scooters and motorcycles ranges from 1.5 kW -3 kW. As these scooters and motorcycles run with a motor that provides decent power output and efficient speed, electric scooters and motorcycles with this motor usage are expected to grow considerably during the forecast period. This power range strikes a balance between performance and efficiency, offering users enhanced capabilities without sacrificing energy conservation or affordability. These scooters are well-suited for navigating both city streets and suburban roads, providing users with a reliable and convenient mode of transportation for various daily needs. One of the key advantages of electric scooters in this power range is their improved performance compared to lower-powered models. With motor outputs between 1.5 kW and 3 kW, these scooters offer faster acceleration and higher top speeds, making them more suitable for longer commutes and handling diverse urban terrain. This increased power allows riders to maintain higher speeds and easily navigate inclines, enhancing overall ride comfort and efficiency. Manufacturers worldwide offer different vehicle models in a 1.5 kW – 3 kW motor power range. Gogoro (Taiwan) offer Gogoro CrossOver GX250 electric scooter with a 2.5 kW direct drive motor that can reach speeds of over 60 kmph and has a range of 111 km. Additionally, Greaves Electric Mobility Private Limited (India), Yadea Technology Group Co., Ltd. (China), and Niu International (China) offer Ampere Magnus EX with 2.1 kW, Yadea E8S with 2.0 kW, and NQiGT S with 3.5 kW motor power, respectively.

“The commercial use of electric scooter is expected to show significant growth during the forecast period.”

Fleet owners delivering goods and services to their customers increasingly rely on electric scooters and motorcycles. Electric two-wheelers often come equipped with advanced telematics and fleet management systems. These technologies enable real-time tracking, route optimization, and efficient fleet management, improving delivery efficiency. Businesses can monitor vehicle performance, schedule maintenance, and analyze data to optimize operations. Using electric scooters/mopeds and motorcycles can significantly reduce delivery costs and improve profitability. Meal delivery companies across the globe use electric scooters. For instance, in December 2023, Uber Eats (US) partnered with Gogoro (Taiwan) for Green Delivery Program. The partnership is word USD 30 million. Uber Eats delivery partners will receive discounts on new Gogoro Smartscooters and battery swapping programs and be given incentives for deliveries on Gogoro Smartscooters. Through the program, Uber Eats expects EV deliveries in Taiwan to double from nearly 20% to 40% by the end of 2025. Also increasing fuel prices, the need to rationalize costs, favorable government policies, and rising awareness of emission-free vehicles would boost the adoption of electric scooters for commercial use in the forecasted period.

“Europe is expected to become second largest growing market for electric scooter during the forecast period.”

Europe is home to many electric two-wheeler manufacturing companies, such as Silence Urban Ecomobility (Spain), Energica Motor Company (Italy), GOVECS (Germany), and Piaggio (Italy). The automotive industry is one of the key contributors to Europe’s economy. The increasing concerns over carbon emissions by conventional ICE two-wheelers and efficiency in this mode of travel have led European two-wheeler manufacturers to develop electric scooters and motorcycles. Government initiatives have encouraged the key players in the market to develop advanced electric two-wheelers and the infrastructure for charging facilities. The rising demand for electric two-wheelers has allowed new players to increase their regional presence. In April 2024, British e-scooter manufacturer Swifty Scooters launched the UK’s first road-legal e-scooter – the GO GT500. Honda Motor Co., Ltd. (Japan) launched its first electric two-wheeler for Europe, the EM1 e, in May 2023. The vehicle uses Honda’s Power Pack swappable battery technology. Ultraviolette Automotive’s (India) F77 electric motorcycle is scheduled to be available in Europe in the second quarter of 2024.

Governments of various European countries are subsidizing electric infrastructure, and the focus will continue to be on electric vehicles in the long run. The EU’s charging network is growing faster than the EV fleet, and most countries already have enough infrastructure to comply with the Alternative Fuels Infrastructure Regulation (AFIR) in 2024. Eight countries are expected to meet their 2025 targets, and many are close to meeting their 2026 targets. However, the EU’s charging network still needs to quadruple by 2030. Hence, the electric scooter market in Europe will grow in the future.

Key Players

The electric scooter market is dominated by established players such as Yadea Technology Group Co., Ltd. (China), Ola Electric (India), TVS Motor Company (India), Ather Energy (India), and Gogoro (Taiwan).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=142827777

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Rohan Salgarkar

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/electric-scooter-motorcycle-market-142827777.html