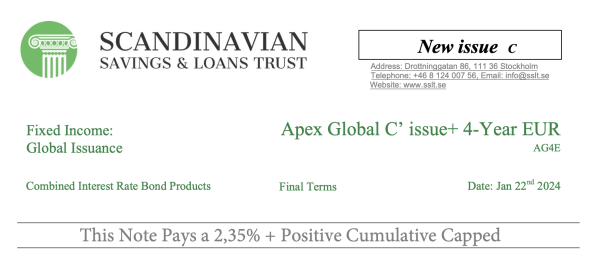

Scandinavian Savings & Loans Trust KB Announces New Financial Product: Apex Global C+ 4-Year EUR Notes

Scandinavian Savings & Loans Trust Kommanditbolag (SSLT KB) is excited to announce the launch of its latest financial product, the Apex Global C+ 4-Year EUR Notes. This innovative product is designed to offer investors both high returns and safety on their principal amount, with a 100% capital and performance guarantee.

Product Highlights:

- Issuer: Scandinavian Savings & Loans Trust Kommanditbolag

- Issue Date: 22 January 2024

- Maturity Date: 22 January 2028 (4 years)

- Interest Rate: 2.35% per annum, payable annually in arrears on 22 January each year

- Amount Issued: EUR 4 billion

- Issue Price: 100.00%

- Denomination of Units: EUR 1 million

The Apex Global C+ 4-Year EUR Notes are constituted by a selective basket of high-yield corporate and government bonds, providing investors with a high rate of return while ensuring the safety of the principal amount. In a challenging investment environment, this product stands out by offering a blend of security and profitability.

Key Features:

- Capital and Performance Guarantee: Investors are assured of the safety of their principal amount along with a performance guarantee, making it an attractive option for risk-averse investors.

- High Yield Returns: The Notes offer an annual interest rate of 2.35%, providing a stable income stream.

- Callable Feature: The Notes are callable yearly at par by the issuer with 5 business days’ notice, offering flexibility in investment planning.

- Redemption Options: Investors can redeem their notes on specific dates with varying conditions regarding coupon payments and penalties.

Risk Factors:

- Credit Risk: Exposure to the credit risk of the issuer.

- Market Risk: Linked to minimum bond risk.

- Liquidity Risk: Limited redemption dates with penalties for early withdrawal.

- Exit Risk: Principal amount protected only at specified redemption dates, with potential penalties for early exit.

Strategy:

The administration team at SSLT KB has meticulously analyzed international bond markets to select high-yield bonds for the Apex Global C+ 4-Year EUR Notes. By engaging in speculative trading in the secondary bond market, the team aims to achieve the highest possible performance rate of return, potentially providing surplus value to noteholders at maturity.

This press release is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. Please read the full terms and conditions, including risk factors, before investing.

This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Media Contact

Company Name: Scandinavian Savings & Loans Trust

Email: Send Email

Phone: +46 8 124 007 56

Address:Drottninggatan 86

City: 111 36 Stockholm

Country: Sweden

Website: https://sslt.se/